sales tax permit austin texas

Complete in just 3 easy steps. Follow the prompts validating address location and approval.

Its Template Drivers License State Texas File Photoshop Version 2 You Can Change Name Address Bi Drivers License Id Card Template Birth Certificate Template

Independent sales reps of direct sales organizations direct sales organizations are required to collect sales tax from the independent distributors persons requesting a sales tax permit.

. You will need to pay an application fee when you apply for a Texas Sales Tax Permit and you will receive your permit 2-3 weeks after filing your application. Complete in just 3 easy steps. In obtaining a sales tax permit a seller agrees to act as an agent for the state for the collection and remittance of sales tax as prescribed by law.

Ad Get started apply for your Texas Sales Tax Permit. Austin collects the maximum legal local sales tax. In Texas this permit is also known as a resale certificate a wholesale license a resale license a sellers permit and a sales permit.

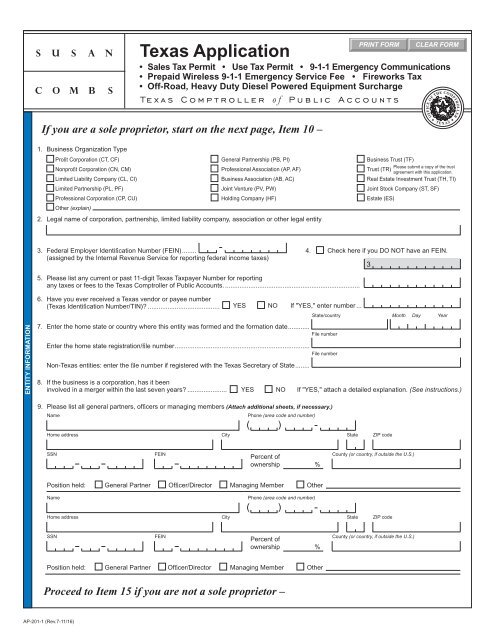

Skip the lines apply online today. State Texas Sales Tax Permit- Current Update Feb 2022. Ad Download Or Email AP-201 More Fillable Forms Register and Subscribe Now.

Resellers Permit Austin Texas NiRetail Trade Online Clothing Sales in Austin Hays County TX. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The 825 sales tax rate in Austin.

Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used. An Austin Texas Sales Tax Permit can only be obtained through an authorized government agency. Share ideas online about improving Austin Participate in the City Sign up for email updates City contact information Business.

Taxpayer ID is an eleven digit number assigned by the Texas Comptroller. The minimum combined 2021 sales tax rate for Austin Texas is. GENERAL INSTRUCTIONS Texas Sales and Use Tax.

Skip the lines apply online today. This dataset includes 746 thousand taxpayers sales tax permit holders registered with Texas Comptroller of Public Accounts. Fast easy and secure filing.

A resale certificate allows a. Ad State Texas Sales Tax Permit Same Day. You must obtain a Texas sales and use tax permit if you are an individual partnership corporation or other legal entity engaged in business in Texas and you.

Ad State Texas Sales Tax Permit Same Day. 2 Get a resale certificate fast. Or httpscomptrollertexasgovweb-formstax-help Sales Tax Permit - Comptroller of Public Accounts httpscomptrollertexasgovtaxespermit.

Also called a TXsellers permit state id wholesale resale reseller certificate. Get your Texas Sales and Use Tax Permit. In TX you may also need a sales tax ID AKA sellers permit if you sell merchandise that is taxable.

This is the total of state county and city sales tax rates. The Texas sales tax rate is currently. Local taxing jurisdictions cities counties special.

Depending on the type of business where youre doing business and other specific. Fast easy and secure filing. Look on the Sales and Use tax menu under Account Self-Service and select Request a Duplicate Sales Tax Permit.

Ad 1 Fill out a simple application. The County sales tax rate is. State Texas Sales Tax Permit- Current Update Feb 2022.

Ad Get started apply for your Texas Sales Tax Permit. Each business is registered with taxpayer number.

Como Sacar El Sales Tax Permit En Texas Ganar Dinero Por Internet Como Ganar Dinero Texas

How To Register For A Sales Tax Permit In Texas Taxjar

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

How To File And Pay Sales Tax In Texas Taxvalet

How To Register File Taxes Online In Texas

How To Get A Resale Certificate In Texas Startingyourbusiness Com

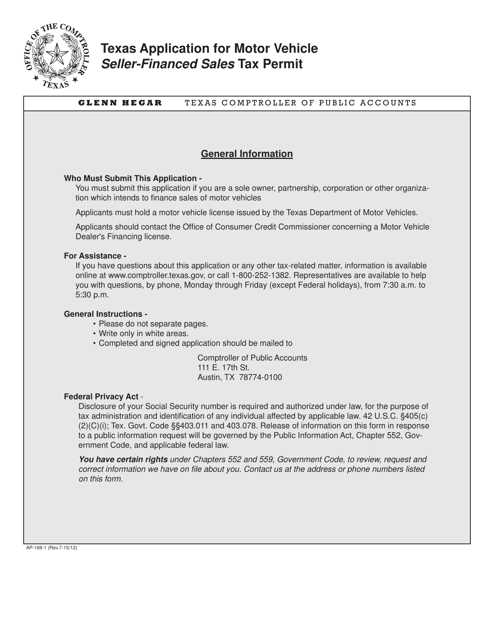

Form Ap 169 Download Fillable Pdf Or Fill Online Texas Application For Motor Vehicle Seller Financed Sales Tax Permit Texas Templateroller